DSCR loans can help borrowers purchase or refinance investment properties without submitting income verification, tax returns, or any of the documentation that traditional loans typically require. DSCR lenders primarily consider whether the property’s income can cover its expenses.

Even with those advantages, the DSCR lender you choose still matters. Many DSCR lenders are slow, taking upwards of 30 days to close. It’s also not uncommon for them to notify you right before closing that your application has been rejected, even after previously confirming you were qualified.

Here's how to tell if a DSCR lender will close quickly or cause unnecessary delays and drama:

- How quickly can they give you a term sheet? A great way to estimate a lender’s closing speed is by looking at the time it takes them to give you a term sheet. If they are slow at this, it shows they have inefficient processes, which may also delay closing. The best DSCR lenders issue term sheets quickly, often within 24 hours of applying.

- Are they a direct lender or broker? Brokers often cause last-minute rejections since they must send your application to a lender and wait for them to underwrite before giving you a yes or no. If lenders spot issues late in underwriting, it leads to last-minute drama. Choose a direct lender as they know their requirements and can tell you upfront if you qualify.

To help you choose the right lender in the context of the criteria listed above, we discuss five of the best DSCR lenders in the U.S., beginning with ourselves, Constitution Lending, and how we use automated tools such as our DSCR loan pricer and documents portal to close faster than other lenders.

Then, we review alternative options like Lima One Capital, New Silver Lending, Kiavi, and Griffin Funding.

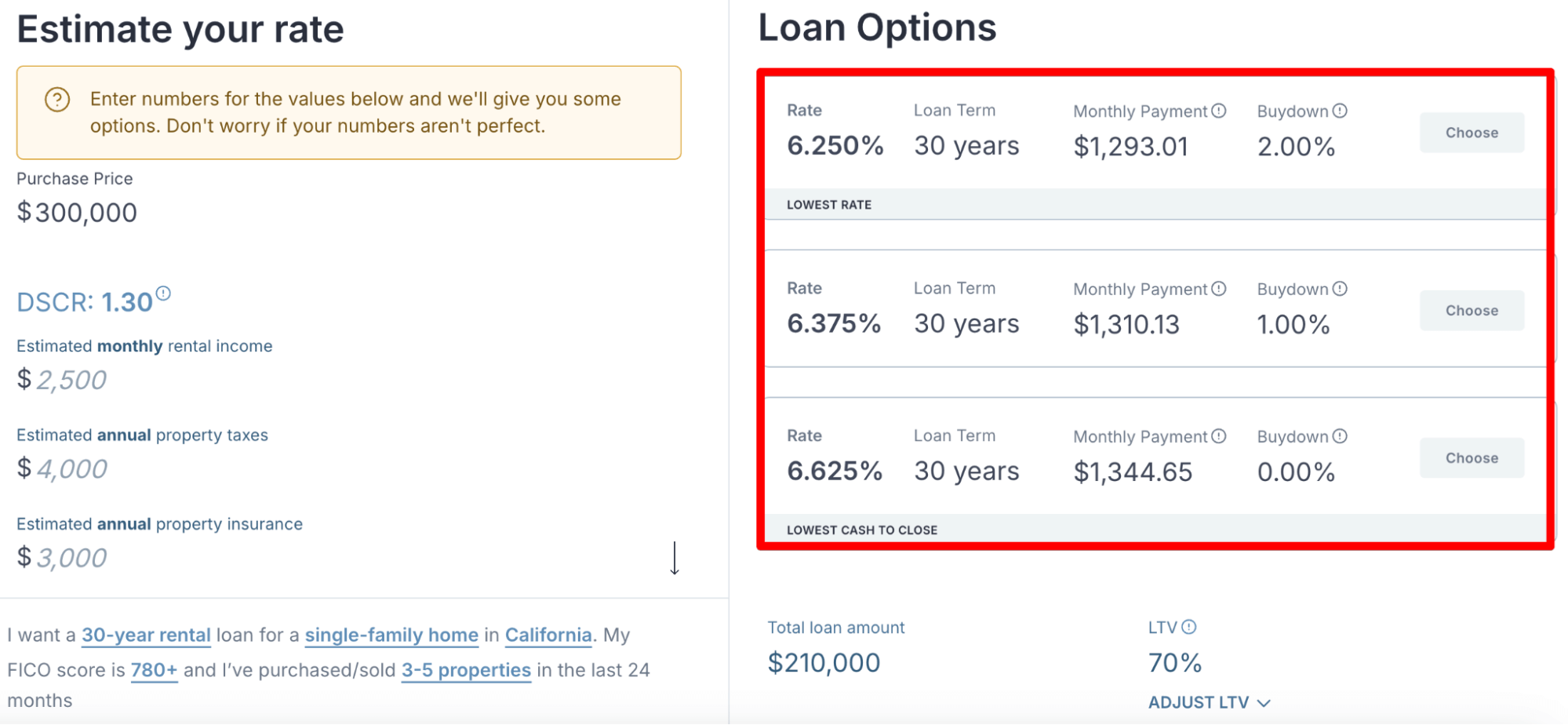

Use our DSCR loan pricer to generate a quote within seconds and see what interest rates you qualify for.

1. Constitution Lending: Fast Funding Built to Help You Compete with the Speed of Cash Buyers

Constitution Lending is a direct hard money lender that offers DSCR loan programs to real estate investors (both first-time and seasoned investors) looking to quickly and reliably finance deals.

We founded Constitution Lending based off our previous bad experience with lenders. We’ve been investing in real estate for several years and understand how long many lenders take to close.

Additionally, we discovered that many “lenders” were actually brokers who couldn’t approve our application until the actual lender completed underwriting. So, sometimes the loan officer didn’t know whether we qualified until we were already a month into underwriting and near the closing date. This led to frequent last-minute rejections.

We designed Constitution Lending to fix these common industry problems.

Here’s what borrowers say about our speed and reliability:

Below, we discuss what sets Constitution Lending apart from other DSCR lenders.

Constitution Lending Can Close Within 7 to 14 Days

Enter a few details into our loan pricer (e.g., the state your property is in, what type of property you’re looking to purchase or refinance, and your credit score), and it’ll generate three quotes:

From here, you can tweak your LTV and purchase price to see how it affects your interest rates, DSCR, and monthly repayments. If you like one of our quotes, click on it, enter your contact details, and you’ll receive a term sheet and pre-approval letter immediately.

After that, we send you access to our documents portal, where you can submit the necessary paperwork, and we’ll fund the loan within one week. In scenarios where borrowers have all the documentation ready and need a loan urgently, we’ve closed DSCR loans within four days.

Compare this process to that of many DSCR mortgage lenders. They don’t provide you with an instant quote or term sheet; you have to complete a contact form on their website, wait days before a loan officer gets back to you, answer countless questions on the phone, and wait another few days for a term sheet and pre-approval letter.

Read more: How to Get a Commercial Loan for a Rental Property in 5 Steps

Constitution Lending is a Direct Lender

Constitution Lending is a direct lender, meaning we’re financing your loan. We aren’t brokers who’re connecting you with the actual lender.

The benefit of this is that we know exactly what our loan requirements are and can guarantee closing as soon as you submit the required documents. We won’t come back to you at the last minute with a rejection letter like brokers so often do.

In contrast, brokers are simply intermediaries between you and the actual lender. Since they aren’t funding the loan, they sometimes don’t know if you qualify until you’re already late in the underwriting process. If the lender finds issues near the closing date, it can cause last-minute drama and rejections.

We’ve been in these situations only to learn at the last minute that our application has been rejected because of certain requirements that the broker didn’t know about.

Avoiding this was one of the reasons we started Constitution Lending.

Read more: DSCR Loan Pros and Cons: A Detailed Guide for Investors

Get Fast, Low-Interest DSCR Loans with Constitution Lending

Generate an instant quote using our DSCR loan pricer and we’ll send you a pre-approval letter and term sheet immediately.

2. Lima One Capital

Lima One Capital is a hard money lender that offers real estate investors a variety of loan products, such as DSCR (debt service coverage ratio) loans, fix-and-flip loans, bridge loans, and ground-up loans.

Here’s a quick overview of Lima One’s hard money loans:

- They are available in five, 10, and 30-year loan options.

- Borrowers can get up to 80% LTV on a purchase and 75% LTV on a cash-out refinance.

- The loan amounts range from $75,000 to $1,000,000.

- There’s no personal income required.

- The property’s cash flow should settle at least 75% of its expenses

In addition to long-term rental loans, Lima One also has short-term rental loans for Airbnb properties. These loans require a 1.5 DSCR and 700 FICO score; borrowers can get a maximum LTV of 75% on purchases and 70% on refinances.

To apply, you have to fill out a contact form on Lima One’s website, telling them more about the investment property you’re looking to purchase — such as the asking price and number of units — and a loan officer will reach out within a few business days.

From here, the loan officer requires you to submit documentation, such as proof of funds, entity documents, and a credit report, and then they send you a term sheet. However, Lima One doesn’t say exactly how long it takes them to issue term sheets.

3. New Silver Lending

New Silver Lending is a direct lender that offers private money to real estate investors. They provide hard money loans, DSCR loans, fix-and-flip loans, bridge loans, and construction loans.

Here’s a summary of the metrics New Silver Lending considers when issuing DSCR loans:

- A minimum down payment of 20% is required.

- The origination fee is usually around 2%–3% of the loan amount.

- The mortgage loan term is set at 30 years.

- Interest rates start at 7.5%.

- Borrowers can apply for loans ranging from $150,000 to $3,000,000.

- The minimum FICO score is 660.

In order to apply for a DSCR loan, you can fill out an application form on New Silver Lending’s website. Here, they ask questions to get a better understanding of the real estate investment’s value, potential rental income, and debt obligations.

They give you an initial quote based on the information you entered and ask you to set up a call with one of their loan officers. This loan officer will get you pre-approved and ask a couple of additional questions to gauge your eligibility. Once you submit all necessary paperwork, they order the appraisal and close your loan.

4. Kiavi

Kiavi is a private lender that operates in 32 states and Washington D.C. In addition to DSCR loans, Kiavi also offers rental portfolio loans, where investors can consolidate the loan payments of five properties or more into a single mortgage payment.

Kiavi offers the following terms on their DSCR loans:

- Interest rates start at 7%.

- Fixed and interest-only DSCR loans are available.

- Borrowers can qualify for a LTV as high as 80%.

- There’s no prepayment penalties after three years.

- 5/1 and 7/1 ARM is available (i.e., your interest rate stays the same for the first five or seven years and changes once a year after that).

When applying, borrowers need to create an account on Kiavi’s website and complete a loan application form. From there, one of Kiavi’s loan officers will call you and ask you to submit all necessary documents — such as bank statements and entity documents — and then order the appraisal.

5. Griffin Funding

Griffin Funding is a direct-to-consumer mortgage lender specializing in lending to self-employed borrowers. In addition to non-QM loans like DSCR loans, they also offer commercial real estate loans, traditional mortgage loans, and VA home loans.

Like all the best DSCR lenders, they don't require you to submit pay stubs, tax returns, or income verification like you would when applying for conventional loans. Their main consideration is your property’s net operating income and DSCR ratio.

Here’s an overview of Griffin Funding’s DSCR loan terms:

- A property needs to generate enough cash flow to settle 75% of its debt obligations.

- Fixed-rate and variable rate 30-year loans are available.

- Loan amounts range from $100,000 to $20,000,000.

Additionally, Griffin Funding provides DSCR loans for short-term rental properties like Airbnbs. To qualify, a property needs to generate a DSCR of at least 0.75, the borrower should have a minimum credit score of 700, and the property must have an occupancy rate of 60% or more.

In order to apply, borrowers can create an account on Griffin Funding’s website and fill out the application form before receiving a quote. If they like the interest rates and terms of the quote, they can submit documents on the website, and a loan officer will reach out with a term sheet.

From here, the application process is similar to that of many DSCR lenders. The loan officer orders the appraisal, begins underwriting, and sends over the finalized loan terms.

If you’re looking to apply for a DSCR loan, use our automated pricer to get an instant quote and we’ll send you a term sheet within 24 hours.